Federal Reserve Expands Main Street Loan Facilities

The Federal Reserve Board has expanded its Main Street Lending Program, promulgated under the CARES Act, to allow more small and medium-sized businesses to take advantage of the support.

Particularly, by extending the maturity from four to five years and extending the payment deferral from one to two years, businesses will be in a better position to take advantage of the program without, in the short-term, substantial impacts on cash flow.

Citing a desire to reduce errors and other problems, the board has taken a slow and cautious approach rolling out the program. It is currently focusing on educating lenders and borrowers on the program details and the process for becoming eligible.

Despite the fact that the special purpose vehicle (SPV) created in connection with the program has not yet started purchasing loans, the board is encouraging lenders to fund program loans immediately, in advance of the opening of the SPV.

Lenders Will Take the Reins

Lenders will drive the loan process under the program. Borrowers will apply using its lender’s application and will ultimately execute the lender’s loan documents, subject to certain program requirements being included. Lenders are required to conduct an assessment of each borrower’s financial condition, using the eligibility criteria in the term sheets as the minimum requirements and applying their own underwriting standards.

Lenders will have the opportunity either to submit a borrower’s loan package to the SPV for pre-approval and an issuance of a commitment letter, or to fund the loan and send a closed loan package to the SPV for purchase.

Once approved by the board, the SPV will purchase a 95 percent interest in the loan. The program will use the SPV to purchase loan participations until Sept. 30, 2020.

Nonprofits Are Not Yet Eligible

In its announcement, the board reiterated that it is working on a loan program that will benefit nonprofit organizations, but – to date – nonprofits are unable to participate in the Main Street program.

Expanded Terms and New Term Sheets

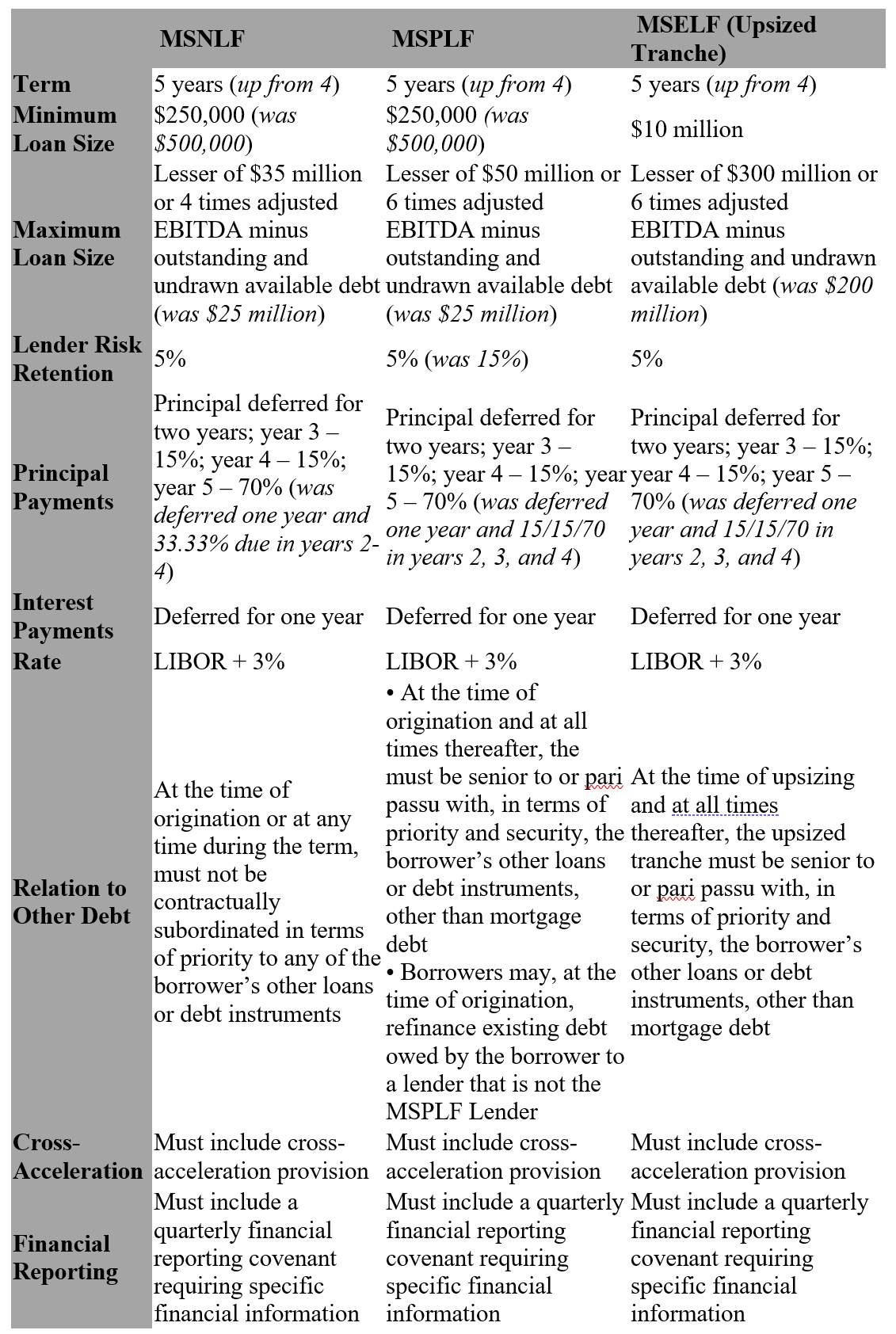

The board issued updated term sheets for each of the three program loan facilities: Main Street New Loan Facility (MSNLF); Main Street Priority Loan Facility (MSPLF); and Main Street Expanded Loan Facility (MSELF).

Unlike loans under the Paycheck Protection Program (PPP), Main Street loans will not be forgiven. The size of the loans, favorable terms, and deferral of payments should make them attractive to many businesses who were unable to take advantage of the PPP. Even if a business did receive a PPP loan, it may also utilize the Main Street program.

The principal terms of each of the program facilities are as follows (with changes from the previous versions in parentheses):

Additional Issues Regarding Terms and Conditions

Adjusted EBITDA: When the program was first announced in April, there was uncertainty about how lenders and borrowers were supposed to calculate adjusted 2019 earnings before interest, taxes, depreciation, and amortization (EBITDA).

For MSNLF and MSPLF, the methodology a borrower will use when calculating its adjusted 2019 EBITDA must be a methodology the program lender previously required to be used for adjusting EBITDA when extending credit to the borrower or to similarly situated borrowers on or before April 24, 2020.

For MSELF, the methodology a borrower must use when calculating its adjusted 2019 EBITDA must be the methodology the program lender previously required to be used for adjusting EBITDA when originating or amending the underlying loan on or before April 24, 2020.

Collateral: MSNLF Loans, MSPLF Loans, and MSELF Upsized Tranches may be secured or unsecured. An MSELF Upsized Tranche must be secured if the underlying loan is secured. In such case, any collateral securing the underlying loan must secure the MSELF Upsized Tranche on a pari passu basis. Lenders may require borrowers to pledge additional collateral to secure an MSELF Upsized Tranche as a condition of approval.

Disclosure of Information: The board will disclose information regarding the MSNLF, MSPLF, and MSELF during the operation of the facilities, including information regarding names of lenders and borrowers, amounts borrowed and interest rates charged, and overall costs, revenues and other fees on a statistical release titled “Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks.”

Eligible Businesses

For each of the program facilities, the borrower must have been in “sound financial condition prior to the onset of the COVID-19 pandemic.” For the MSNLF and MSPLF, any outstanding loan with the program lender as of Dec. 31, 2019, must have had an internal risk rating of “pass.” With respect to the MSELF, the existing facility must have been originated on or before April 24, 2020, must have a remaining maturity of at least 18 months, and must have had a risk rating of “pass” as of Dec. 31, 2019.

Also, to be eligible, a business organization must:

- Be for-profit

- Have been established prior to March 13, 2020, under the laws of the U.S. or Indian Tribal government

- Not be ineligible pursuant to 13 CFR § 120.110(b)-(j), (m)-(s)

- Either have

- (a) 15,000 or fewer employees (counted pursuant to SBA rules, including affiliation rules) or

- (b) 2019 annual revenues of $5 billion or less

- Be an entity with significant operations in and a majority of its employees based in the U.S. (a borrower may be a subsidiary of a foreign company so long as it meets this standard and does not use program loan proceeds to benefit the foreign parent)

- Only participate in one of the program facilities and must not also participate in the Primary Market Corporate Credit Facility.

- Make all of the certifications and covenants required under the program

Borrower Certifications, Restrictions and Covenants

While lenders will be free to use their own application forms and loan documents, the program requires that borrowers make certain certifications and covenants with each program facility and there are specific forms and instructions for borrowers and lenders.

Among other things, borrowers will have to:

- Agree not to pay dividends or make distributions until 12 months after repayment of the loan. A borrower that is an S corporation or other pass-through entity may make distributions to cover its owners’ tax obligations.

- Covenant to limit increases in executive compensation.

- Commit, if they are borrowers that have securities listed on a national exchange, to not repurchase a security issued by the borrower and listed on a national exchange until 12 months after the term of the loan.

- Commit that it will not repay any debt (unless the principal and interest is mandatory and due) until the loan is paid in full. Under the MSPLF, at the time of origination, the borrower may use the proceeds to refinance existing debt to a lender other than the program lender.

- Commit that it will not cancel or reduce any lines of credit until the loan is paid in full.

- Certify that it is not a “covered entity” as defined in the CARES Act and therefore is not prohibited from participation in the program due to a conflict of interest. A covered entity is an entity in which the president, vice president, head of an executive department, or a member of Congress, or a family member of any of the above, holds a controlling interest.

- Certify that it is unable to secure adequate credit facilities from other lenders. (This is not an absolute; it is enough to certify that the borrower is unable to secure adequate credit due to inadequate amount, price, or terms of credit for current unusual circumstances).

- Certify that it is not insolvent (failing to pay debts as they become due during the 90 days preceding the loan for reasons other than disruptions resulting from COVID-19).

- Certify that the financial information submitted with the application are true and correct

- Certify that it has a reasonable basis to believe it has the ability to meet its financial obligations for at least the next 90 days.

- Certify, if the borrower is a holding company, that the loan is guaranteed by its subsidiaries

- Make commercially reasonable efforts to maintain its payroll and retain employees.

The lender has to:

- Certify that it will not use proceeds to repay or refinance preexisting loans or lines of credit.

- Certify it will not cancel or reduce any existing lines of credit to the borrower.

- Attest that the methodology used for calculating the borrower’s adjusted 2019 EBITDA is the methodology it has previously used for adjusting EBITDA when lending to the borrower or similarly situated borrowers.

- Certify it is eligible to participate in the program.

[***Please note that these materials are provided for informational purposes only and should not be a substitute for legal or accounting advice. In all instances, individuals and companies should consult with their own legal and accounting professionals]