After a multi-year boom fueled by the rise of delivery apps and the broader digital transformation of the restaurant industry, venture capital flowing into restaurant tech has sharply slowed, according to a new report from PitchBook.

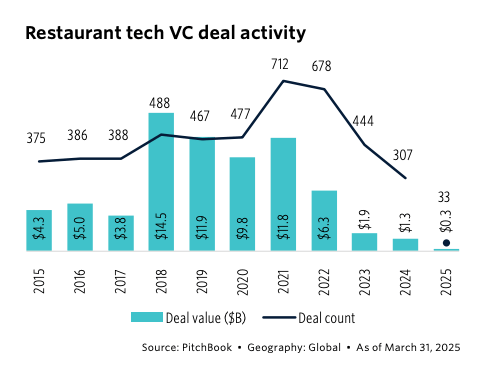

The report, titled Q2 2025 Tech Landscape: Restaurant Technology, shows that total VC funding in the space dropped to just $1.3 billion in 2024, down from a peak of $14.5 billion in 2018. Restaurant tech accounted for only 12% of total food tech venture investment in 2024, compared to a commanding 60% in 2018.

Restaurant tech’s shrinking share of food tech investment isn’t entirely surprising, given the maturation of delivery marketplaces, a sector that drew a wave of generalist investors during the 2010s. As once-scrappy startups like DoorDash, Deliveroo, and Grubhub evolved into established players and opportunities in the delivery space dwindled, many of those tourist investors moved on.

Still, PitchBook sees pockets of opportunity in restaurant tech, particularly around AI and automation. The report highlights emerging tools that use AI for personalized marketing, demand forecasting, and operational efficiency. AI-powered, human-language interfaces are also gaining traction, with companies like Hi Auto, ConverseNow, and Slang AI bringing automation to drive-thrus and phone-based ordering. Major chains such as Wendy’s and Yum! Brands are doubling down on these systems, even as McDonald’s recently pulled back from its AI ordering pilot and its experimental beverage-focused brand.

PitchBook is cautiously optimistic about robotics and automation in restaurants, a sector that has seen high-profile flameouts like Zume. According to the report, the market has shifted from startups trying to build full-stack systems to more targeted point solutions being tested and deployed by established players. Companies like Hyphen and Miso Robotics are among those providing modular automation tools now being adopted by operators.

On the consumer-facing side, startups focused on guest management and loyalty platforms have also emerged as bright spots for investors. Blackbird Labs and Dorsia each raised $50 million in early 2025, while SevenRooms announced a notable exit with a $1.2 billion acquisition by DoorDash.

Looking ahead, PitchBook expects deal flow to remain measured. The restaurant industry’s notoriously thin margins—combined with ongoing economic uncertainty—will likely keep tourist VCs on the sidelines. However, startups that leverage AI and automation to drive operational efficiency are expected to continue drawing investor interest.